THORChain’s Plan to Reduce Volatility

In this article, we’ll dive into the effects of volatility on THORChain’s key stakeholders and explore how the network is taking systematic steps to bring more stability to RUNE.

This report was first published on 2024-10-17

Disclaimer: This research report is intended for informational purposes only and does not constitute financial advice.

RUNE's volatility has long been a double-edged sword. While it can ignite speculation and drive growth, it also brings instability that reverberates across the entire THORChain ecosystem. For Liquidity Providers (LPs) and Node Operators (NOs), these fluctuations can pose real challenges, complicating long-term participation and profitability.

In this article, we’ll dive into the effects of volatility on THORChain’s key stakeholders and explore how the network is taking systematic steps to bring more stability to RUNE.

The Impact of Volatility on Stakeholders

THORChain’s design tightly intertwines RUNE’s volatility with the health of the entire network, making it a pivotal concern for stakeholders such as Liquidity Providers and Node Operators. Understanding how RUNE's price swings influence decision-making and profitability for these key players is crucial to grasping the broader impact of volatility on the ecosystem.

Liquidity Providers

Among all stakeholders, LPs are the most affected by RUNE's volatility. Since RUNE is paired with every asset in THORChain's network, acting as the settlement layer for all swaps, its price fluctuations have a direct impact on LPs’ positions as the pool needs to keep a 50-50 balance between the asset and RUNE in USD denomination.

As a refresher, Liquidity Pools on THORChain are 50% of a native asset (like Bitcoin) and 50% Rune, in USD value. This ratio is always maintained. If the price of Rune increases or decreases faster than the native asset, the pool becomes imbalanced. Assets are bought or sold to restore the 50:50 balance, which changes the amount of tokens in the LP positions.

For example, if Rune’s price doubles while Bitcoin stays the same, the pool will sell some Rune and buy Bitcoin. This results in the LP holding fewer Rune but more Bitcoin than before. This difference in tokens is called Impermanent Loss (IL), which represents the potential reduction in value the LP might experience compared to just holding the assets outside the pool without providing liquidity.

If RUNE’s price fluctuates more than its counterpart, LPs may find themselves holding less value than if they had simply held the assets outside of the pools. During periods of high volatility, IL can erode the profitability of liquidity provision, driving LPs to re-evaluate their participation in the ecosystem.

To mitigate losses, LPs depend on earning enough fees to offset the potential Impermanent Loss. Still, when RUNE’s volatility spikes beyond tolerable levels, fees may no longer cover the risk of Impermanent Loss, making liquidity provision potentially unprofitable. In such cases, LPs may choose to withdraw liquidity, triggering a reduction in the overall pool liquidity. This, in turn, leads to higher slippage, reduced capital efficiency and worsen the volatility of the tokens in the pools.

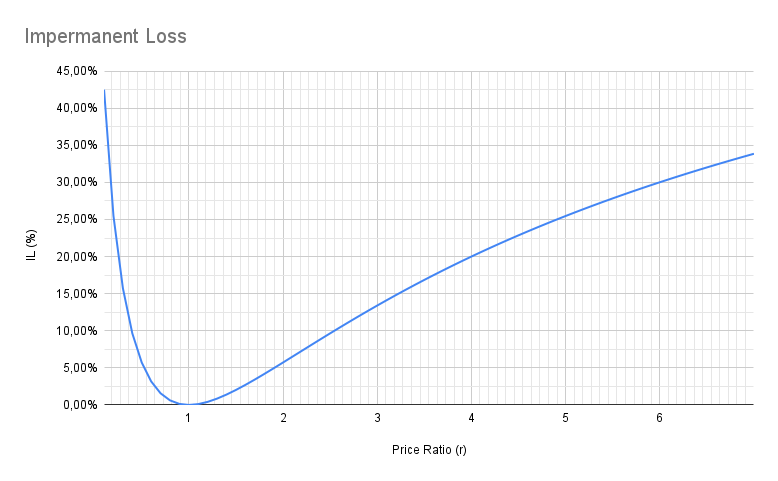

For a 50:50 pool, the Impermanent Loss formula can be computed using the formula below, where r being how much the price of one asset has changed relative to the other.

IL = 1- 2r1+r

The chart below illustrates the relationship between price changes (percentage change in RUNE’s value relative to its paired asset) and the Impermanent Loss. For example, in a RUNE-BTC pool, if 1 BTC initially costs 30,000 RUNE but later rises to 60,000 RUNE, the ratio r would be equal to 2. Conversely, if the price of RUNE loses half its value compared to Bitcoin, 1 BTC would cost 15,000 RUNE and r would be equal to 0.5.

Anyone checking a BTC-RUNE chart will notice that RUNE has been highly volatile against Bitcoin, with price variations between the two assets sometimes reaching 3x leading to a potential Impermanent Loss of around 15% which could significantly impact LPs profits.

Let’s consider an example. If the price ratio r = 2 , the IL would be approximately 5%, meaning that a LP position would be worth 5% less in USD compared to simply holding the assets outside the pool. However, the LP position generates fees and according to DeFiLlama, the current 30-day APY for a BTC-RUNE pool is around 23%. Factoring in the 5% IL, the effective yield drops to approximately 18%.

High yields can make LPs more tolerant of volatility, but when yields decline or fluctuate due to market dynamics, even moderate price volatility from RUNE can prompt LPs to reconsider their positions. The need to closely monitor LP performance, combined with IL eroding gains, makes it challenging for LPs to predict their gains and set profitable strategies.

Node Operators

Node Operators face a different, yet equally important, set of challenges related to RUNE’s volatility. To operate a THORNode, Node Operators and their Bond Providers must bond a substantial amount of RUNE (typically around 1 million). This high capital requirement makes Node Operators highly sensitive to price fluctuations, as their exposure directly impacts the network’s security and governance.

For Node Operators, downside volatility poses an obvious risk as capital losses can erode their yield expectations (currently around 12%), making it less attractive to bond RUNE and participate in the network.

Sharp upward swings in RUNE’s price can also be problematic for bond providers willing to enter the network. For example, an institution planning to acquire 1 million RUNE at $5 per token would face a $5 million outlay. But if RUNE’s price doubles overnight to $10, the cost of operating that Node jumps to $10 million, making it significantly more expensive to participate. Such volatility complicates long-term planning and introduces uncertainty, particularly for institutional players who may view THORChain as risky.

Existing Node Operators are also influenced by these price swings. When RUNE’s price surges, operators may be tempted to take profits by reducing their bond or exiting entirely. In periods of high volatility, the focus can shift from generating long-term yield to capitalising on short-term price movements, which undermines network security and governance. As Nodes exit to chase price gains, the stability of the network could be compromised, affecting the broader ecosystem.

How Does RUNE's Volatility Stack Up Against Other Assets?

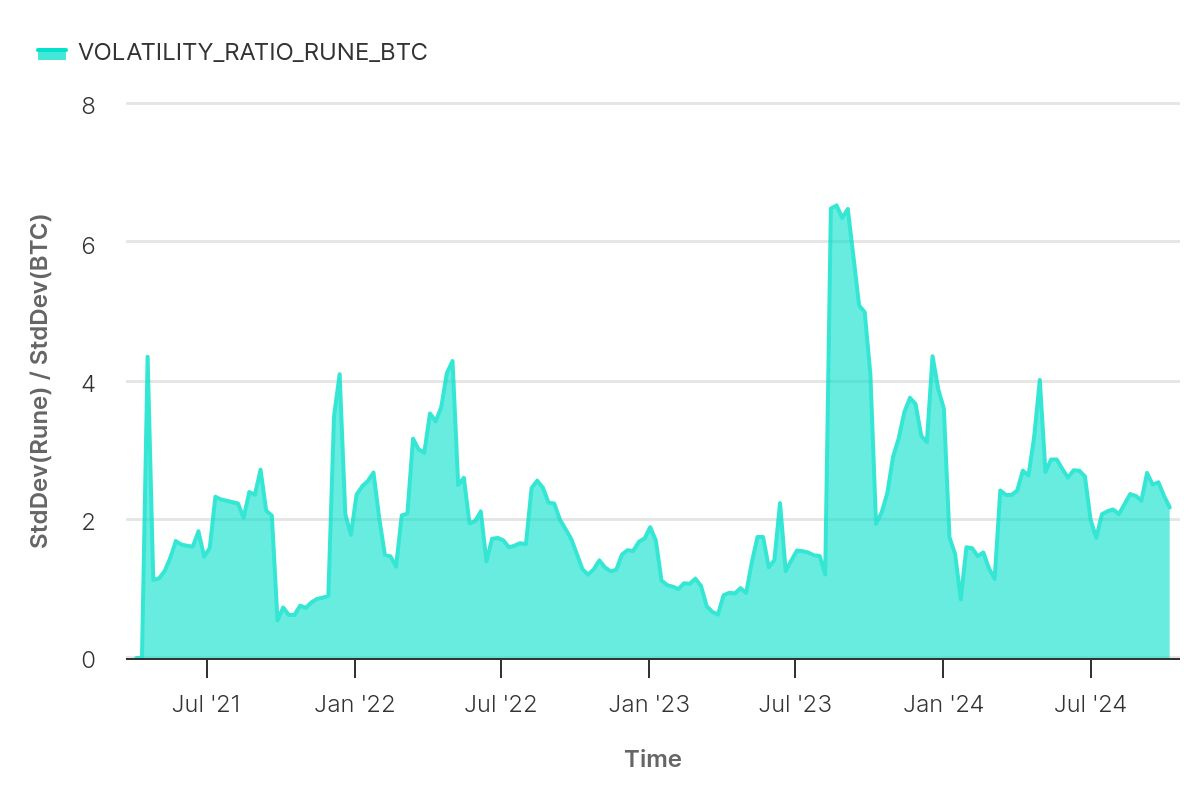

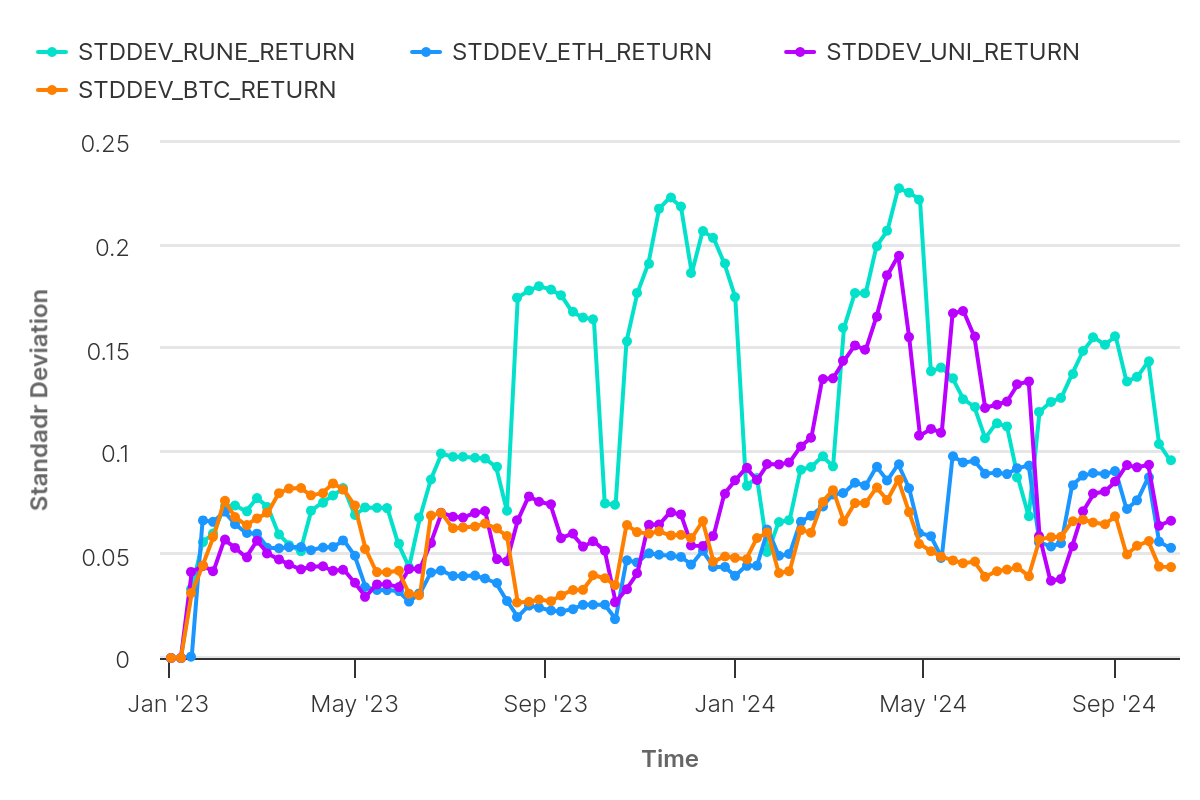

Now that we understand why volatility is something LPs and Nodes try to avoid, it’s worth looking at how RUNE's volatility has changed over time and how it compares to other assets.

Volatility compared to Bitcoin

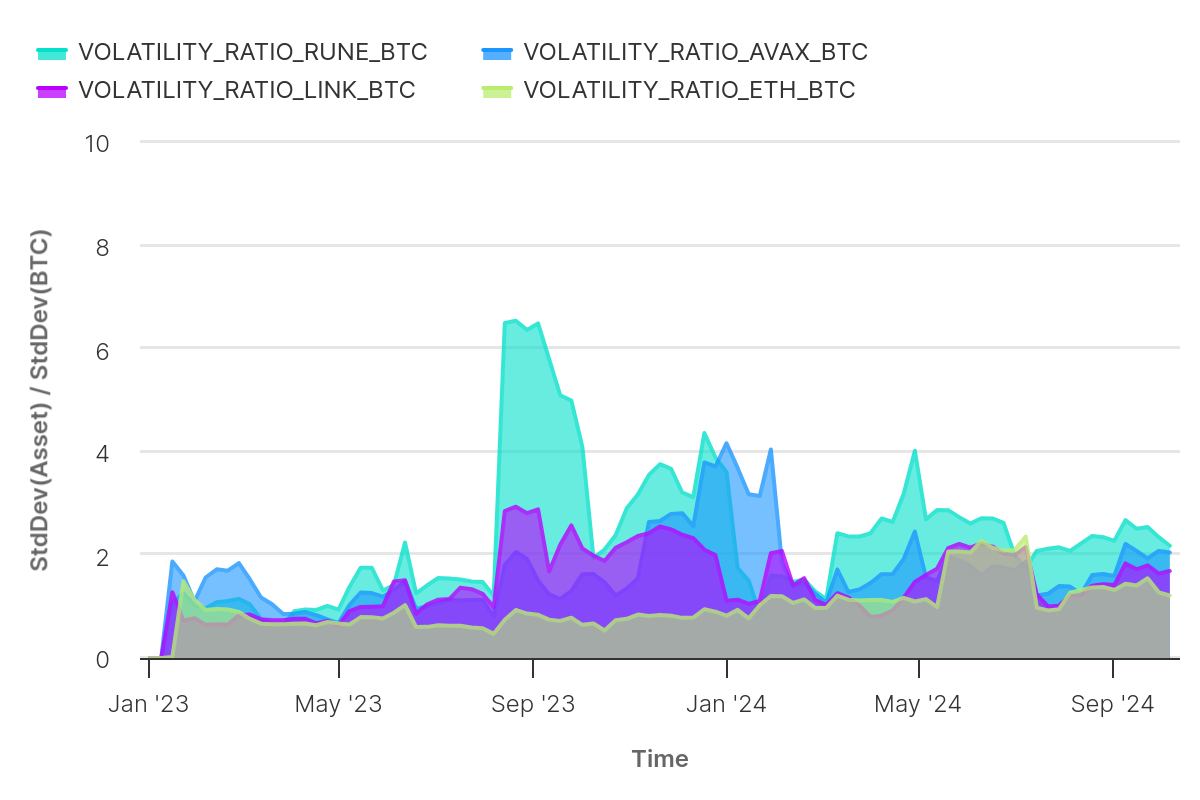

The chart below provides a comparative analysis of RUNE's volatility ratio against BTC, AVAX, LINK, and ETH, covering the period from January 2023 to the present. This ratio is calculated by dividing the standard deviation of each asset’s price by that of BTC. A ratio equal to 1 means that the asset's volatility is similar to Bitcoin's. A ratio greater than 1 provides a rough estimate of how much more volatile the asset is compared to Bitcoin.

A key observation is that RUNE consistently exhibits higher volatility compared to major assets like ETH, AVX and LINK, particularly during the launch of new features within the THORChain ecosystem. For instance, RUNE's volatility ratio spiked to 6.49 between late July and August 2023, coinciding with the introduction of significant features such as streaming swaps and lending. These developments heightened speculation and reflexivity within the ecosystem, leading to a much more volatile RUNE than many of the major assets.

This trend is not merely a recent occurrence, it reflects a broader pattern over time. Since 2021, RUNE's volatility has shown recurring spikes, especially when the ratio climbs above 4. A notable example occurred in March 2024, when the ratio reached 4, coinciding with the scaling of lending through ADR012, which had an impact on the price due to the burn mechanism.

Setting aside the specific features introduced by THORChain, RUNE’s volatility generally fluctuates between 1.5 and 3, and has remained relatively stable since the start of 2024 (excluding the spikes caused by the ADR012). This is a positive sign, and if the ratio could decrease and stabilise within the 1.5 to 2 range, RUNE's volatility would be comparable to that of major, well-established projects.

Thus, one could argue that to reduce RUNE's volatility, it may be beneficial to limit large developments that introduce reflexivity into the network, as these events clearly contribute to the heightened volatility observed in RUNE. This is already being addressed through Rujira, the App Layer

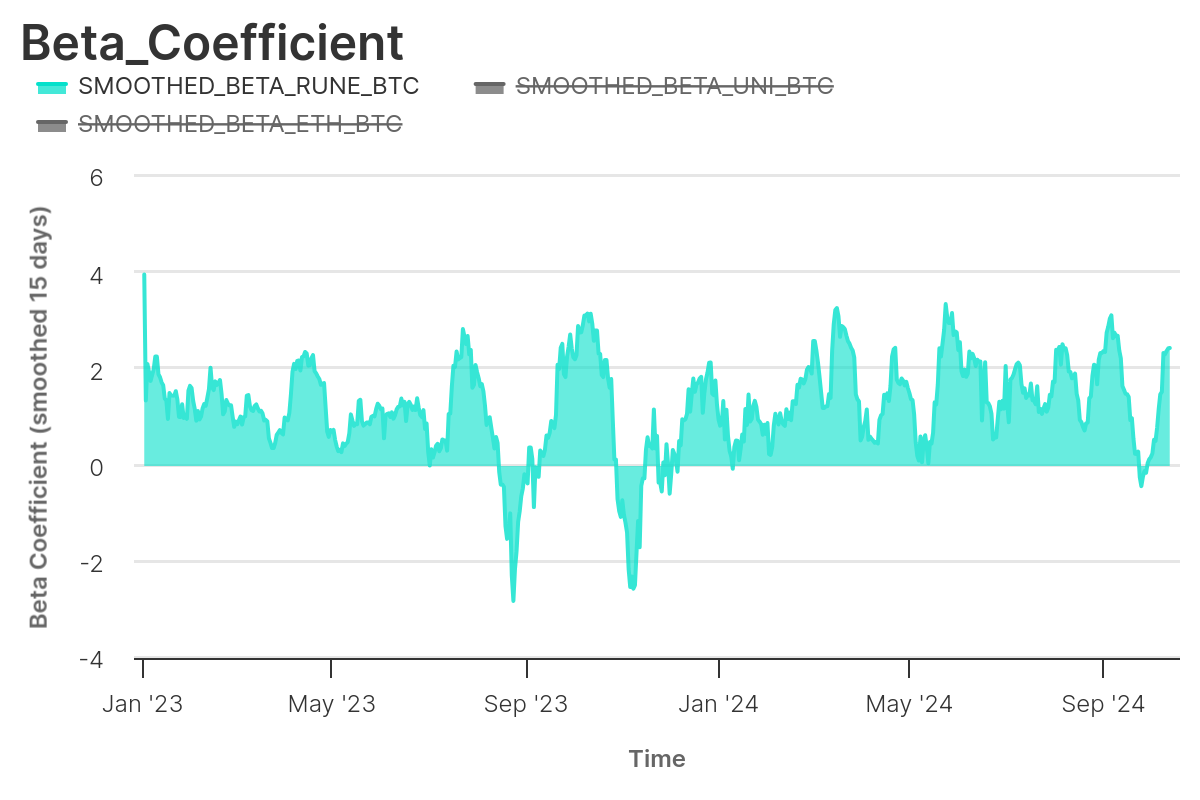

Beta coefficient

Another aspect influenced by new features and upgrades to THORChain is the correlation between RUNE and BTC, as illustrated by the beta coefficient. RUNE typically exhibits a relatively high and positive beta against BTC, indicating greater volatility and a tendency to move in the same direction as Bitcoin.

For Liquidity Providers, the correlation between RUNE and BTC is important because it suggests that both assets tend to respond similarly to market movements. This alignment can help reduce the risk of Impermanent Loss, as LPs are more likely to maintain value when the two assets move in the same direction.

However, an interesting pattern emerges when new features are introduced. For instance, in August 2023 and October 2023, the beta coefficient of RUNE against BTC dropped to around -2.8. This shift coincided with the launch of streaming swaps and lending, which significantly impacted RUNE's correlation with BTC.

Such a decorrelation suggests that while RUNE usually moves in tandem with BTC, major upgrades can create temporary disconnections, leading to increased volatility and risk for LPs’ profitability.

Does RUNE Need to Reduce Its Volatility?

As shown in the chart below, which compares RUNE's volatility to assets like ETH, BTC, and UNI, RUNE consistently exhibits significantly higher volatility. While this volatility may attract traders looking for quick gains, and holders may enjoy rapid price surges driven by speculation around new features or upgrades, it poses serious challenges for Liquidity Providers and Node Operators.

While some volatility is inevitable in a speculative environment, RUNE’s current levels may be too extreme. Ideally, we would like to see RUNE’s volatility align more closely with that of BTC, where price movements are gradual and upward, allowing for long-term appreciation without the frequent, sharp fluctuations.

Reducing volatility would not only make the asset more attractive for long-term holders but also create a more sustainable environment for LPs and Nodes, ensuring that the network can continue to thrive without the added risk and complexity that high volatility introduces. Additionally, reducing volatility would attract institutions and large players who need to minimise their risk of capital loss. Last but not least, these investors are particularly interested in yield opportunities, and THORChain stands out as one of the few platforms that offers sustainable yields in the crypto industry.

How We Can Reduce the Volatility of RUNE

Now that we’ve established RUNE’s high volatility, the next step is to explore how this can be reduced. THORChain has recognised that stabilising RUNE is essential for attracting institutional interest and ensuring long-term growth. For larger capital allocators and achieving the blue-chip status, stability is key. Several measures are being implemented.

Deleveraging THORChain’s Base Layer

One clear insight from analysing RUNE’s volatility is that many of the spikes were caused by the introduction of new features, such as lending. Much of this volatility stemmed from the burn but also speculation. Reflexivity in the price encouraged traders to speculate on RUNE’s price rather than actively participating as Liquidity Providers or Node Operators.

THORChain has recognised this issue and, with the development of the App Layer Rujira (detailed in this report), has the opportunity to reduce much of this speculation. By deleveraging the base layer, THORChain aims to reduce the number of factors that contribute to volatility.

Pause Lending

The first major step was the recent decision to pause lending, effectively halting the creation of new loans. This lending program allowed users to borrow against their assets, introducing leverage into the system. While the additional liquidity provided short-term benefits, it also encouraged speculative behaviour and heightened volatility with the burn/mint mechanism.

To mitigate this, Node Operators voted to pause the opening of new loans. Existing loans can still be closed out or will remain in the protocol indefinitely. By pausing lending, THORChain has eliminated a source of volatility on RUNE.

Lending will now shift from the Base Layer to the App Layer with the introduction of RUJI Lending. This transition ensures that leverage will continue in a more controlled environment, minimising its effect on RUNE’s price movements and network stability.

Reducing Synth Utilisation

The second major action focuses on synthetic assets (Synths), which allows users to take positions without holding the actual underlying assets, leading to reflexive price movements and volatility. When Synth utilisation exceeded 50% of pool depth, the system became highly sensitive to price fluctuations, further amplifying volatility.

To address this, THORChain is reducing the Synth ratio to 33% of pool depth, limiting speculative exposure and stabilising liquidity pools with more real assets. Additionally, manual swaps to Synths have been disabled. Over time, the goal is to completely minimise synthetic asset exposure. This will gradually scale back Savers by reducing their yield, but this will take time, as the deleveraging process must avoid triggering any unwanted volatility (for example all Savers leaving the network at the same time). Therefore, these changes will be implemented in a controlled manner.

Previously, the Reserve injected RUNE into liquidity pools when Synth utilisation crossed certain thresholds, impacting the volatility of RUNE. By decoupling the Reserve from Protocol-Owned Liquidity, THORChain aims to break this reflexive cycle and stabilise price fluctuations.

To prevent future volatility spikes, experimental designs and new assets, such as synthetic assets, will now be shifted to the App Layer. This ensures that any leverage or volatility generated by these innovations will not impact the Base Layer or RUNE’s volatility, supporting the network's long-term sustainability.

Increasing Fees for Liquidity Providers

Another crucial strategy for reducing volatility is increasing the fees earned by Liquidity Providers, which incentivises more liquidity to flow into the system. As THORChain integrates with large wallets and chains like Solana and Base, the user base will expand, leading to more swaps and, consequently, higher fees for LPs. With increased fees, providing liquidity becomes more attractive, resulting in larger pools that can better absorb price fluctuations and reduce volatility.

In addition, the upcoming fix to the Incentive Pendulum will further boost LP earnings by adjusting the distribution of rewards between Liquidity Providers and Bond Providers. This adjustment will make liquidity positions more profitable while lowering the risk of Impermanent Loss. As more RUNE is locked into liquidity pools, it will help stabilise price movements, reducing volatility driven by speculative market activity.

AutoBond

Lastly, Autobonding is poised to play an important role in reducing RUNE’s volatility by moving tokens from speculative circulation into the network’s security infrastructure. Currently, a significant portion of RUNE is either idle or traded speculatively (on Centralised exchanges for example), contributing to price instability. Autobonding will allow RUNE holders to easily bond their tokens to the network, transforming passive holders into active participants in the system's security.

With more RUNE bonded and locked within the system, speculative pressure in the market is reduced. This not only stabilises the circulating supply but also encourages long-term holding, as bonders earn yield, decreasing the incentive for short-term trading. The result is a more stable asset with less price volatility, benefiting both Liquidity Providers and the overall network.

Final Thoughts

Although it may seem counterintuitive, the best outcome for RUNE would be for its price to closely follow the general market volatility (mainly BTC), making it more stable than most altcoins. This would allow RUNE to appreciate as the broader crypto market grows, providing more predictable returns while significantly reducing volatility.

For RUNE to be optimally utilised within THORChain, it needs to be locked in liquidity pools or bonded by Node Operators. In both cases, the focus is on generating yield rather than chasing speculative price movements.

To attract institutional interest and raise capital for running Nodes or providing liquidity, reducing volatility is essential. As our analysis shows, RUNE’s current volatility is too high, especially during periods of new feature rollouts or network changes. For THORChain to achieve greater stability, its volatility relative to BTC should ideally target a range of 1.5 to 2.

The upcoming initiatives such as deleveraging the base layer, increasing liquidity provider fees, and implementing Auto-Bond will encourage more RUNE holders to become active participants, reducing the volatility of the token. RUNE will switch from being a speculative asset into a powerful yield-generating machine. This will attract both small holders and institutional investors, which are all interested in high yields with minimal risk of capital loss.

===

Support Alpha Hunt on X by clicking here — we’d greatly appreciate your support!

Discover THORChain: Visit Website, follow on X, join Telegram, or connect with developers on the Developer Discord.

Interested in collaborating? Explore our services and learn more on our website.